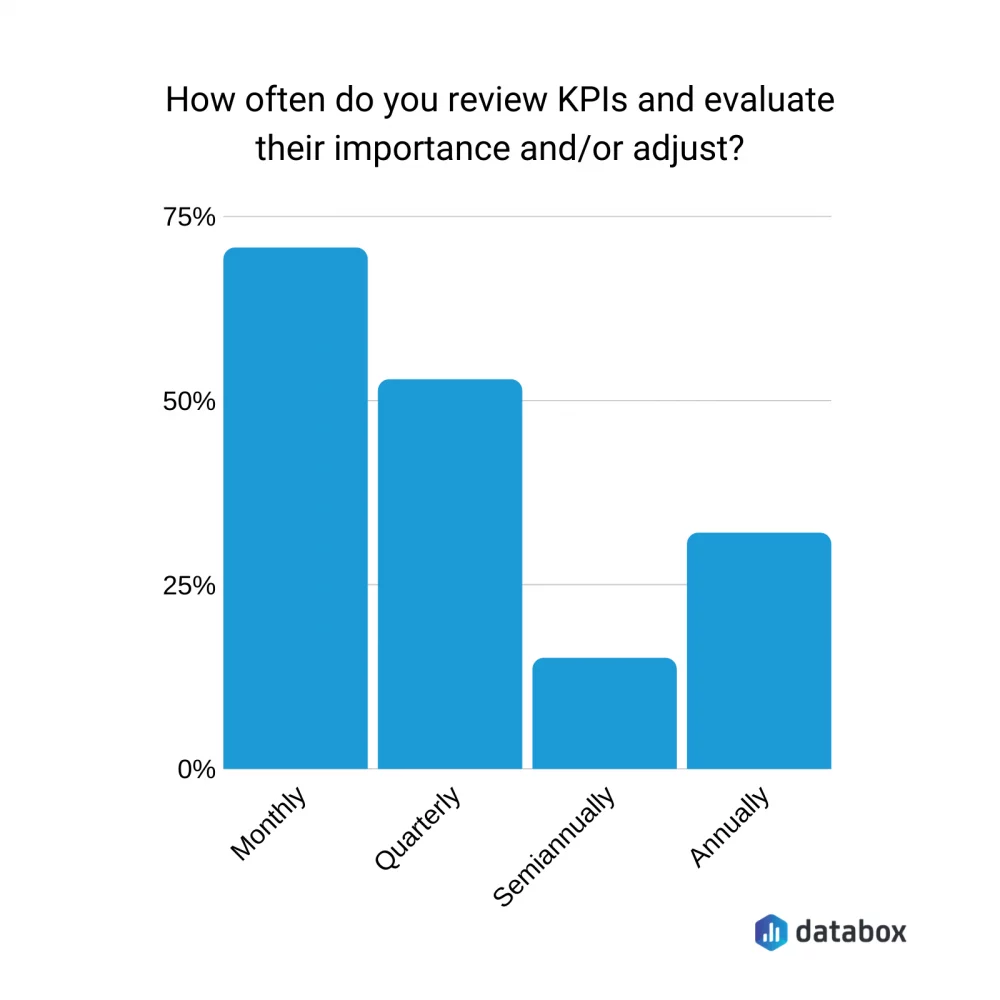

The success of any business, including the marketplace, hinges on the owner’s ability to analyze vital data. This is where KPIs become increasingly important. Over 70% of business owners recognize the need to review KPIs monthly. A thoughtful approach can lead businesses to higher profits and customer retention rates.

KPI Review Statistics

Source: DataBox

Though it’s impossible to pinpoint unique marketplace metrics, we will stress the most vital for this type of business.

All About Marketplace Metrics

You know the best way to track your business’s effectiveness is through key performance indicators (KPIs) and metrics. First, let’s brush off the two terms and their differences.

- KPIs are used to track your performance based on specific business goals.

- Metrics are more generalized terms as they measure business performance for specific activities.

- It’s important to note that all KPIs are metrics, but not all metrics are KPIs.

What are Marketplace Metrics?

Marketplace metrics refer to measurable data points, including KPIs, that businesses use to assess and optimize the performance of online marketplaces. They are essential for evaluating the health and success of a marketplace platform. They help in understanding user behavior and making informed decisions to enhance overall efficiency and profitability.

For example, if you need to track your business performance based on the desired number of active users and the actual number, this is a KPI and a metric. If you wish to measure user activity on different pages to conclude the most popular items, this is a metric that cannot be considered a KPI as it isn’t tied to the strategic goals of your business. So, KPIs are still metrics that can and should be used in tracking business effectiveness.

Types of Marketplace Metrics

Marketplace metrics can vary depending on the measurements and the type of marketplace itself. Below are the most common of them that we will cover in more detail in this article.

- Sales and revenue metrics like gross and net revenue track the performance of a business’s sales efforts and financial outcomes.

- Customer acquisition and retention metrics like customer acquisition costs measure the effectiveness of attracting new customers (customer acquisition) and maintaining existing ones (customer retention).

- User engagement metrics like session duration time gauge users’ level of interaction and involvement with a product or service.

- Conversion metrics like contribution margin evaluate the success of converting potential customers into actual customers or achieving desired actions.

- Project management metrics like task completion rate monitor a project’s progress, efficiency, and success.

- Employee performance metrics like key performance indicators measure the effectiveness and productivity of employees.

They collectively provide a comprehensive view of a marketplace’s health, performance, and areas for improvement. Depending on business goals and strategies, businesses may prioritize specific metrics over others. However, they all stand essential, and the following paragraph will explain why.

Why are Marketplace Metrics Important?

Marketplace metrics are crucial for several reasons:

Performance Evaluation

Metrics provide a comprehensive overview of the marketplace’s performance. Key indicators such as GMV, AOV, and take rate help to assess how well the platform meets its business objectives.

Strategic Decision-Making

Marketplace metrics like return on investment (ROI) and net promoter score (NPS) provide data-driven insights to identify strengths, weaknesses, opportunities, and threats. This, in turn, enables businesses to refine and adjust their strategies accordingly.

User Behavior Analysis

Understanding how users interact with the platform helps tailor the user experience and optimize features to meet customer expectations and improve sales. Click-through rate (CTR), time on page, or conversion rate can help with this.

Efficiency and Optimization

Analyze metrics related to customer acquisition costs, such as process cycle time and cost per conversion, seller performance, and operational efficiency. This will enable you to implement changes to optimize processes and reduce costs.

Financial Health

Metrics like AOV, GMV, and contribution margin to ratio can assess the financial health of the marketplace. This information is vital for budgeting, forecasting, and demonstrating the platform’s economic impact.

Competitive Positioning

Benchmarking against industry standards and competitors is facilitated by marketplace metrics. Understanding how a platform works through metrics like buyer/seller overlap or quick ratio allows you to make strategic adjustments to maintain a competitive edge.

Identifying Growth Opportunities

Metrics like market expansion rate and customer lifetime value (CLV) growth can help identify new opportunities to enter a new market or release a new feature. User engagement can be a good indicator of areas of improvement and business fortes.

Risk Management

Monitoring metrics related to fraud, chargebacks, and security issues enables proactive risk management strategies. This approach will protect both sellers and buyers.

3 Foundational Marketplace Metrics for Business Success

These metrics provided here are crucial for business success. Marketplaces usually can’t assess their effectiveness if these metrics are omitted. We use them in our practice when working with marketplace businesses. Our team always recommends using them for our customers.

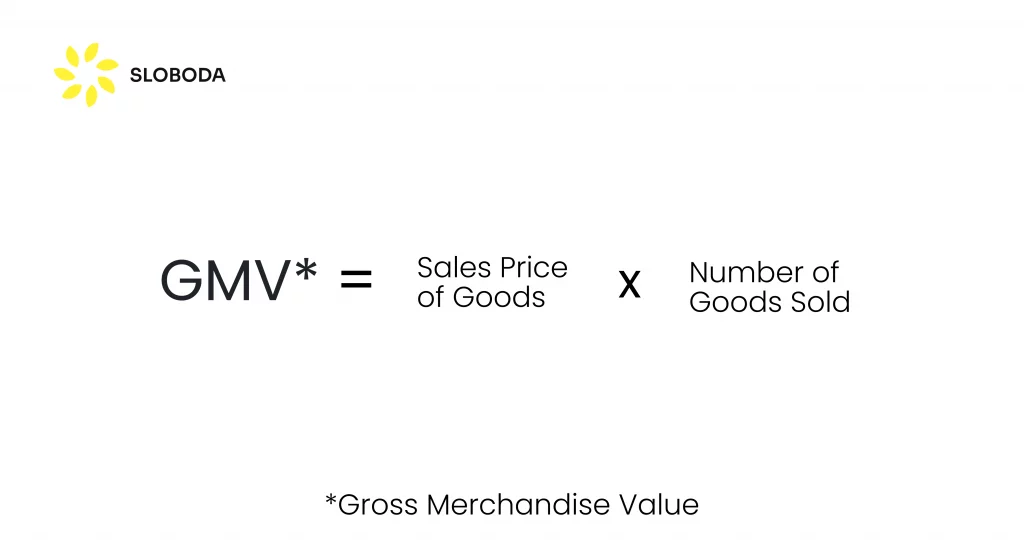

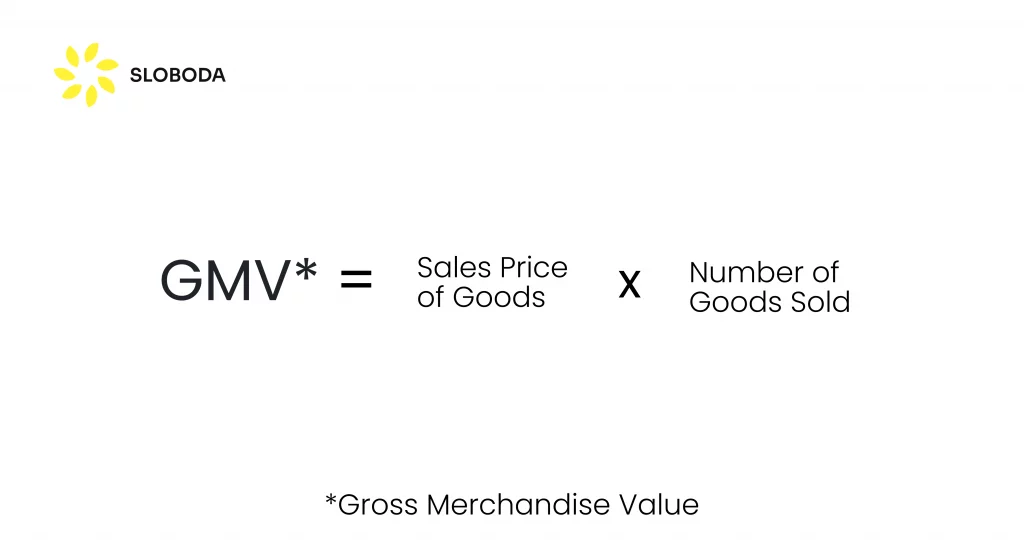

Gross Merchandise Volume (GMV)

Gross Merchandise Volume (GMV) is the total value of all goods and services transacted on a marketplace platform within a specific period. Excluding discounts, returns, and taxes.

GMV serves as a critical metric for assessing a marketplace’s overall economic activity and scale. It provides a foundation for various performance indicators and financial calculations. It is a critical measure of the platform’s transaction volume and potential market impact.

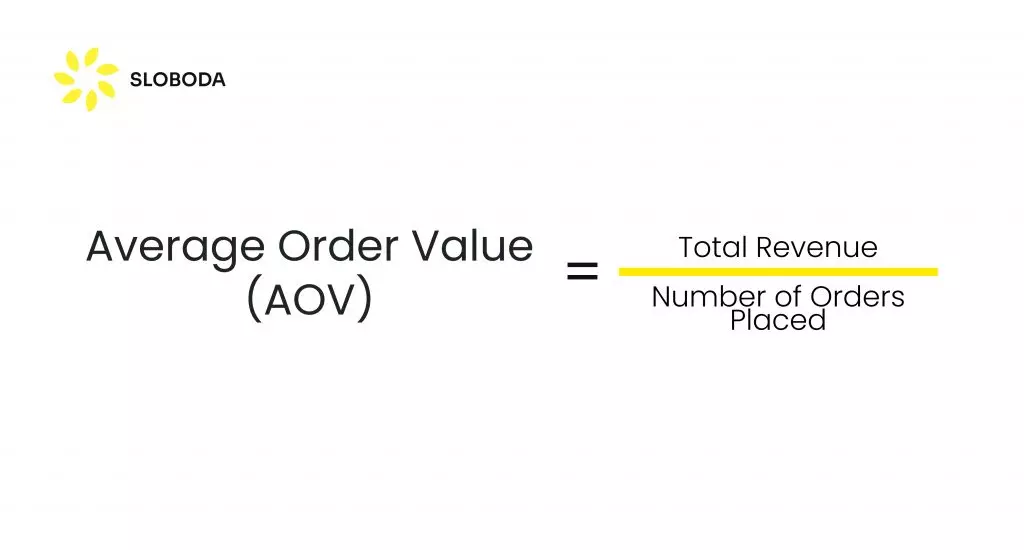

Average Order Value (AOV)

This metric represents the average amount spent by a customer in a single transaction. AOV can be calculated by dividing the total earnings generated by a marketplace by the number of orders within a specified time frame. This provides the amount spent by customers in a single sales deal.

AOV is crucial for understanding customer spending behavior. It is often used to assess the effectiveness of upselling and cross-selling strategies. It helps determine each transaction’s profitability. AOV also can influence marketing budget allocation, product bundling, and customer segmentation decisions.

A higher AOV indicates that customers make more significant transactions, increasing revenue. By strategically targeting and increasing AOV, marketplaces can enhance their financial performance and overall business sustainability.

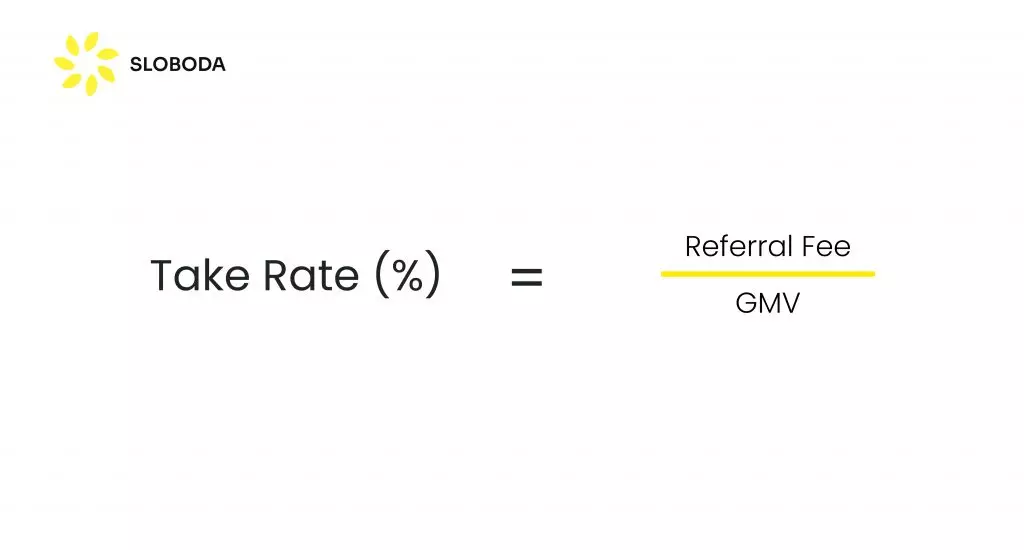

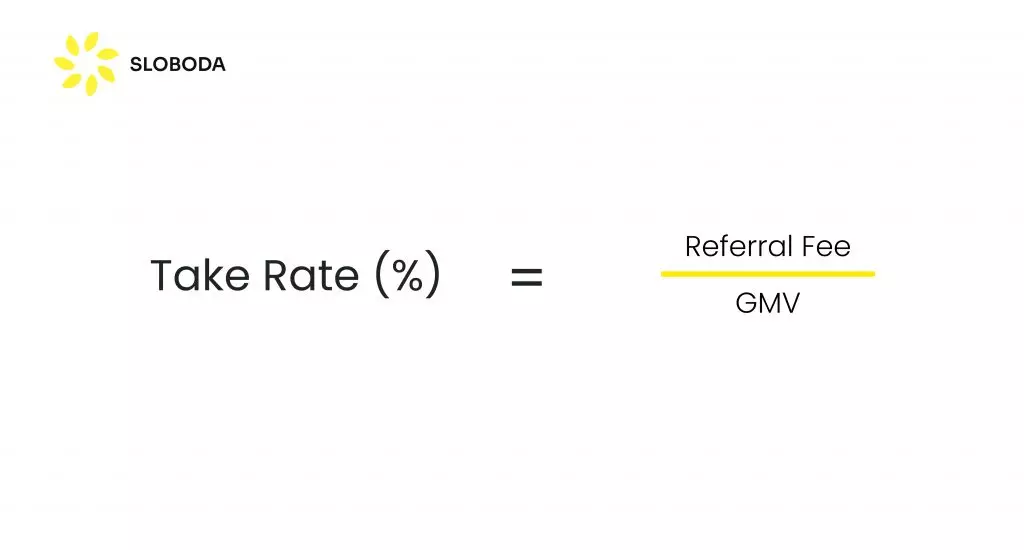

Take Rate

Take Rate is the percentage of revenue the marketplace retains from the total transaction value. It is calculated by dividing the platform’s income by the Gross Merchandise Value (GMV) and multiplying by a hundred.

Take rate offers insights into how effectively the platform monetizes the value of every transaction facilitated. This metric is essential for assessing the financial health of the marketplace and guiding strategies related to pricing models, fee structures, and overall income optimization. A well-managed take rate ensures sustainable profit streams for the platform’s continued growth and success.

Start a successful marketplace

Contact us

Advanced Marketplaces KPIs: Diving Deeper

Let’s move toward more profound and advanced KPIs and metrics.

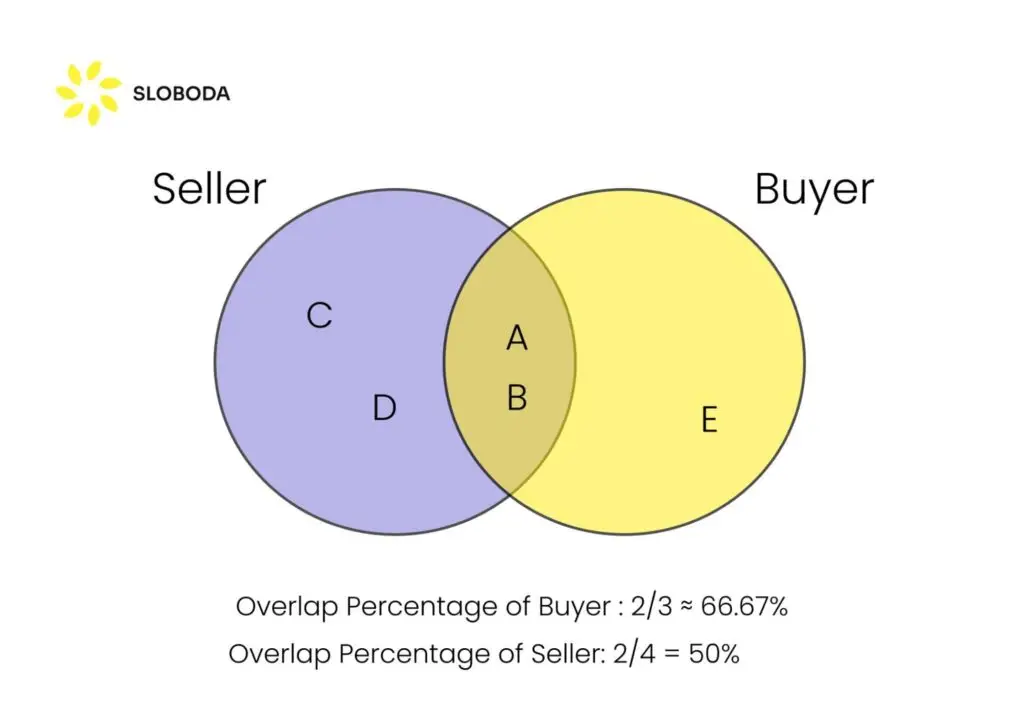

Buyer/Seller Overlap

Buyer/Seller overlap assesses the diversity of sellers a single buyer engages with. This metric provides insights into a particular user’s range of products or services. A high level of

Buyer/Seller overlap indicates a diverse and dynamic marketplace where customers can choose and engage with various sellers. This diversity can contribute to increased customer satisfaction as users find a variety of offerings and options.

Monitoring Buyer/Seller overlap can help you understand user behavior, tailor sales recommendations, and optimize the platform for a more personalized and engaging shopping experience.

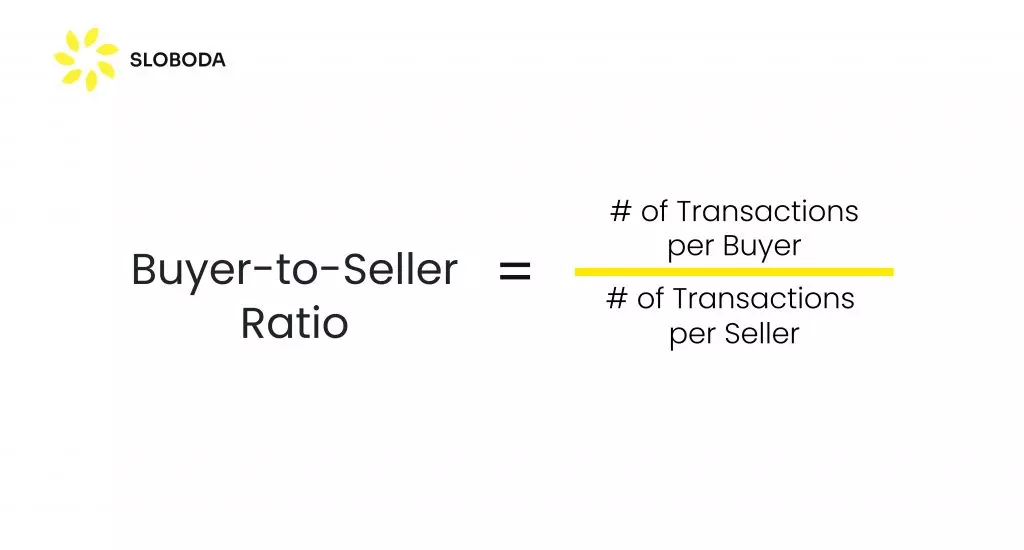

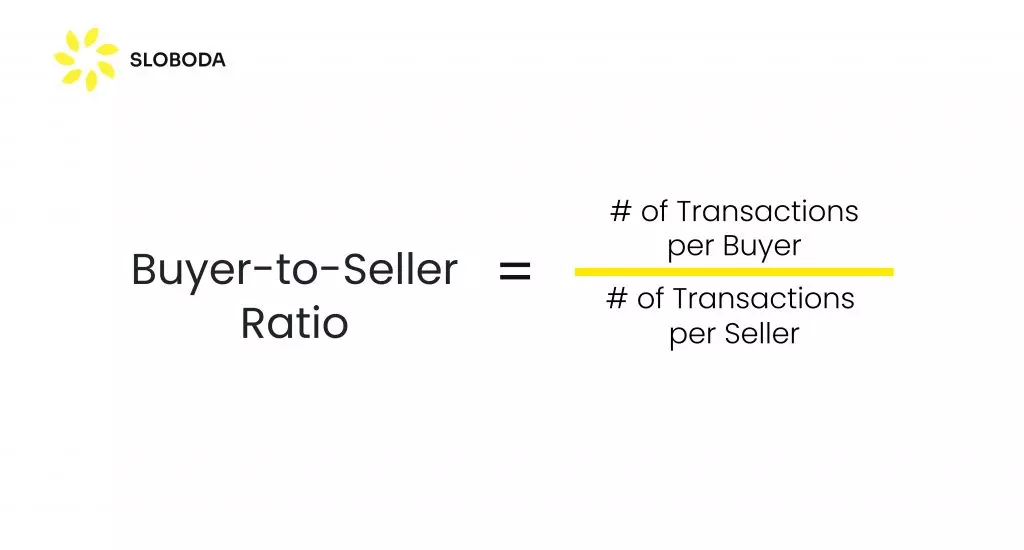

Buyer-to-Seller Ratio

The buyer-to-seller ratio represents the number of buyers to sellers that shows the balance of an app. The Buyer-to-Seller ratio is calculated by dividing the total number of customers by the total number of sellers.

This metric provides a snapshot of the balance between demand and supply in the marketplace. A high ratio may indicate a healthy market for products or services. This can potentially attract more sellers to the platform. Conversely, a lower ratio might suggest challenges in customer acquisition or an oversaturation of sellers.

This metric is valuable for making strategic decisions about marketing efforts, onboarding new sellers, and maintaining a vibrant and balanced ecosystem.

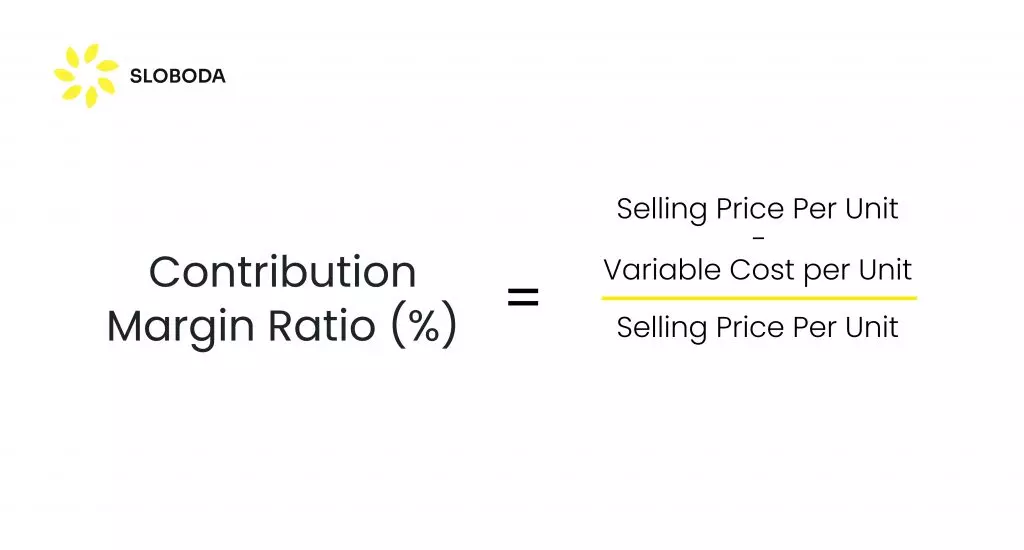

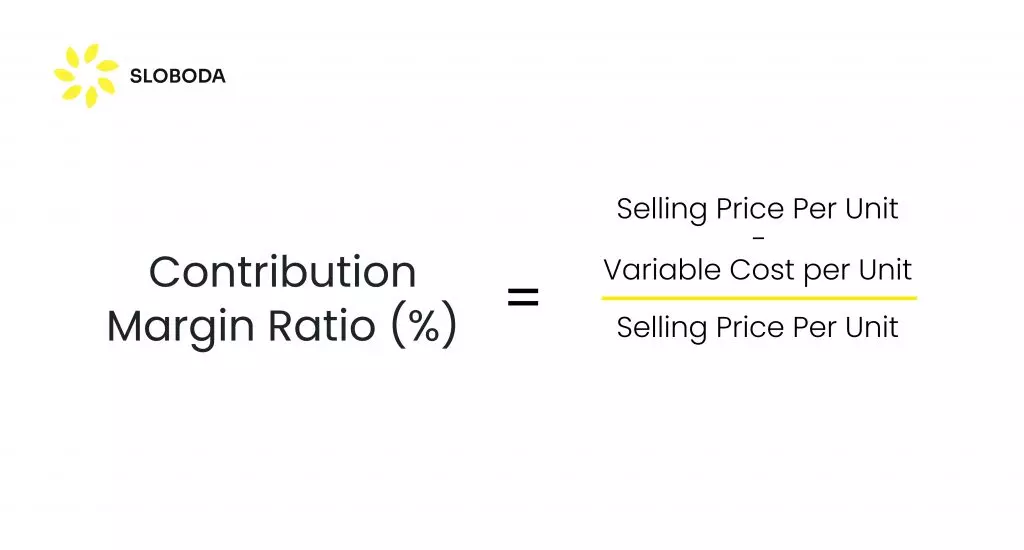

Contribution Margin and Ratio

The profitability of each transaction is calculated by subtracting variable costs. The contribution margin and ratio are calculated by dividing it by total revenue, expressing it as a percentage. These vital metrics assess the profitability of each transaction in a marketplace.

By subtracting variable costs, such as those related to production or fulfillment, from revenue, businesses can determine the portion of income available to cover fixed costs and contribute to revenue. A higher contribution margin ratio indicates a more profitable transaction. It offers insights into the financial viability of the marketplace’s operations.

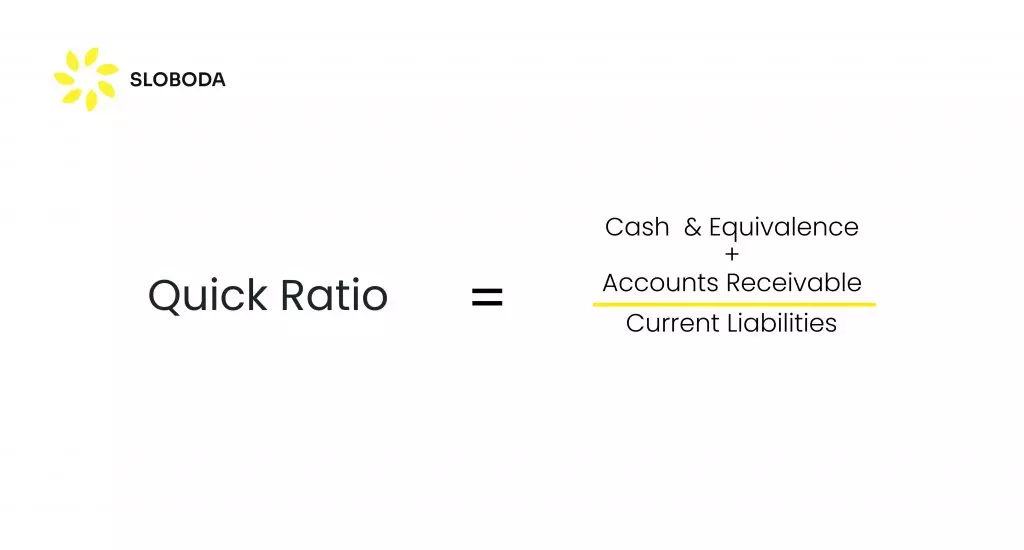

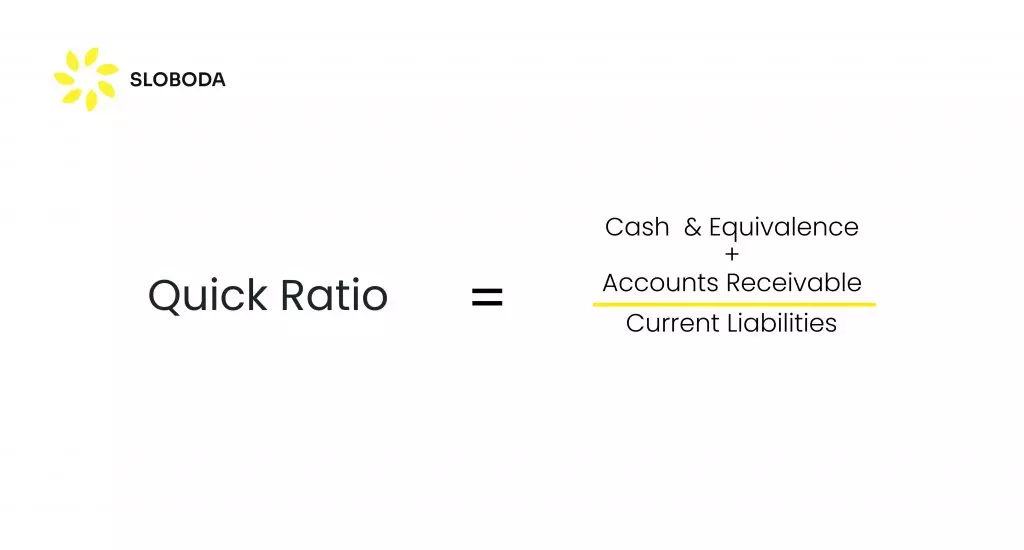

Quick Ratio

The quick ratio metric, also known as the acid-test ratio, is of use to measure a marketplace’s ability to cover its short-term liabilities with its most liquid assets. It is calculated by summing up cash, cash equivalents, and accounts receivable and dividing by current liabilities.

A ratio above one indicates that the new marketplace can cover its short-term liabilities with its most liquid assets, suggesting financial stability. This metric is required to balance growth and churn for successful business operations.

Crucial Metrics for Marketplace Business Owners According to Investors

Now, let’s delve deeper into advice for strategic goals. This paragraph will be crucial for marketplaces that have just started their journey or are even in the planning stage.

We have gathered insights regarding what investors may find important for considering any marketplace funding.

Price-to-Earnings Ratio (P/E Ratio)

A low P/E ratio may indicate undervaluation, making the startup an attractive investment in the time of its prime. On the contrary, a high P/E ratio could signify strong future growth prospects. So, establishing balance should be one of your concerns.

Free Cash Flow

Positive free cash flow demonstrates a company’s ability to generate cash after covering its operating expenses. Investors appreciate businesses that can sustain themselves. It’s also important to have the flexibility to invest in growth opportunities.

Monthly Recurring Revenue (MRR)

MRR reflects the predictable and stable revenue generated from subscriptions. Consistent MRR can win the investor’s attention since it signifies a steady customer base and reliable income streams.

Revenue Growth

Naturally, investors are attracted to startups exhibiting strong revenue growth. A high growth rate suggests that the marketplace is gaining traction and expanding its market share. This is making it an appealing prospect for investment.

Customer Acquisition Cost (CAC) Payback

Efficient customer acquisition cost (CAC) strategies are important for those looking to invest in businesses. A shorter payback period indicates that the cost of acquiring a customer (CAC) is recouped quickly. This demonstrates a well-optimized and scalable business model.

Lifetime Value (LTV)

A high LTV relative to the customer acquisition cost signifies a wide and established customer base. Investors seek startups with a strong LTV to CAC ratio. It implies long-term profitability and sustainability in customer relationships.

Client-Centric Marketplaces Attract Investors

Become one

Best Practices for Measuring and Tracking Marketplace Metrics

You have insights and metrics to focus on, but it’s important to measure the results. So, in this paragraph, we gathered a few tips and tricks that will help you understand this process.

Setting KPI Goals and Tracking the Progress

It’s important that the Key Performance Indicators (KPIs) you identify align with your business objectives. One of the examples might be the exact number of active users you want to engage with your marketplace monthly. Try to establish measurable goals for GMV, conversion rates, and customer satisfaction. Start regularly tracking your progress toward these goals to ensure you stay on course and can make timely adjustments.

Identifying Areas for Improvement

The analysis of the marketplace metrics is important to identify areas for improvement. It’ll be possible to pinpoint specific aspects of the platform that require attention and enhancement. Consider gathering user feedback on time and carefully analyzing it to do this. What users expect and prefer might differ from what you’ve initially planned for the app. Don’t be afraid to pivot. If Instagram or Slack never pivoted, we wouldn’t have them as they are today.

Making Data-Driven Decisions

You should base your strategic decisions on data insights rather than intuition. Leverage tools like Looker, Tableau, and Google Analytics to extract valuable information. For example, intel about user behavior, market trends, and performance metrics. Try to utilize hypothesis validation before making a decision will help in gathering more intel before any significant change. Informed decision-making grounded in data ensures your strategies align with marketplace dynamics and user preferences.

Optimizing Marketplace Operations

Optimize your new marketplace operations based on the incoming data from every KPI you’ve set. Evaluate fulfillment processes and seller performance, identify bottlenecks or inefficiencies, and implement changes. This will enhance operational efficiency, leading to a more streamlined and effective marketplace.

Conclusions

Wrapping up, metrics aren’t ALL that matters in a thriving marketplace. Acknowledging your competitors and learning from their failures and successes is vital. Try using more intel for decision-making and validating hypotheses when implementing new features.

So many details go into building a successful marketplace in 2024 that it’s easy to get lost. However, Sloboda Studio is always ready to assist you. Want to book a consultation? Hop on a call with us.