Author: Igor Hadziahmetovic | Investment Director & Web3 Tech Lead at Venionaire Web3

In the short term, it doesn’t really matter who wins the US elections. The bitcoin price is poised to appreciate further. The reasons for this optimism are manifold; some of the key factors revolve around bitcoin being an accepted hedge against economic turbulence and uncertainty:

- Ever-increasing US national debt and money printing

- Increased weakening of the USD as the world’s reserve currency

- De-dollarization by central banks and rising sovereign debt as demand driver for bitcoin and gold reserves

- Centrals banks, governments, and corporates increasingly include bitcoin along with gold in their reserves and balance sheets

- Financial institutions are increasing their BTC adoption and crypto-industry involvement

- US ETF inflows are increasing, with other countries following suit

On Tuesday, 29-Oct, bitcoin approached its all-time high (ATH) at around $73.6k before quickly retracing. Depending on the trading venue, some prices did breach new highs, as seen with bitcoin CME futures reaching a new ATH at $74,485. The last week of October brought exceptional price performance, with bitcoin closing the month up 10.9%. Currently, we’re seeing price retracements across the board. When bitcoin experiences even minor corrections, altcoins typically face more significant declines due to their higher beta.

Weekend price action, notorious for lower liquidity and reduced trader participation, often allows for wider price swings before Monday’s open. The last weekly close left a large upper wick reaching into the ATH price range, before retracing to close +1.18% higher than its opening price. However, on monthly, weekly, and daily timeframes, bitcoin maintains its bullish stance as long as it holds the $65-66k level. Even a retracement from $74k to $65k, representing a 12.5% decrease, would not disrupt bitcoin’s bullish market structure.

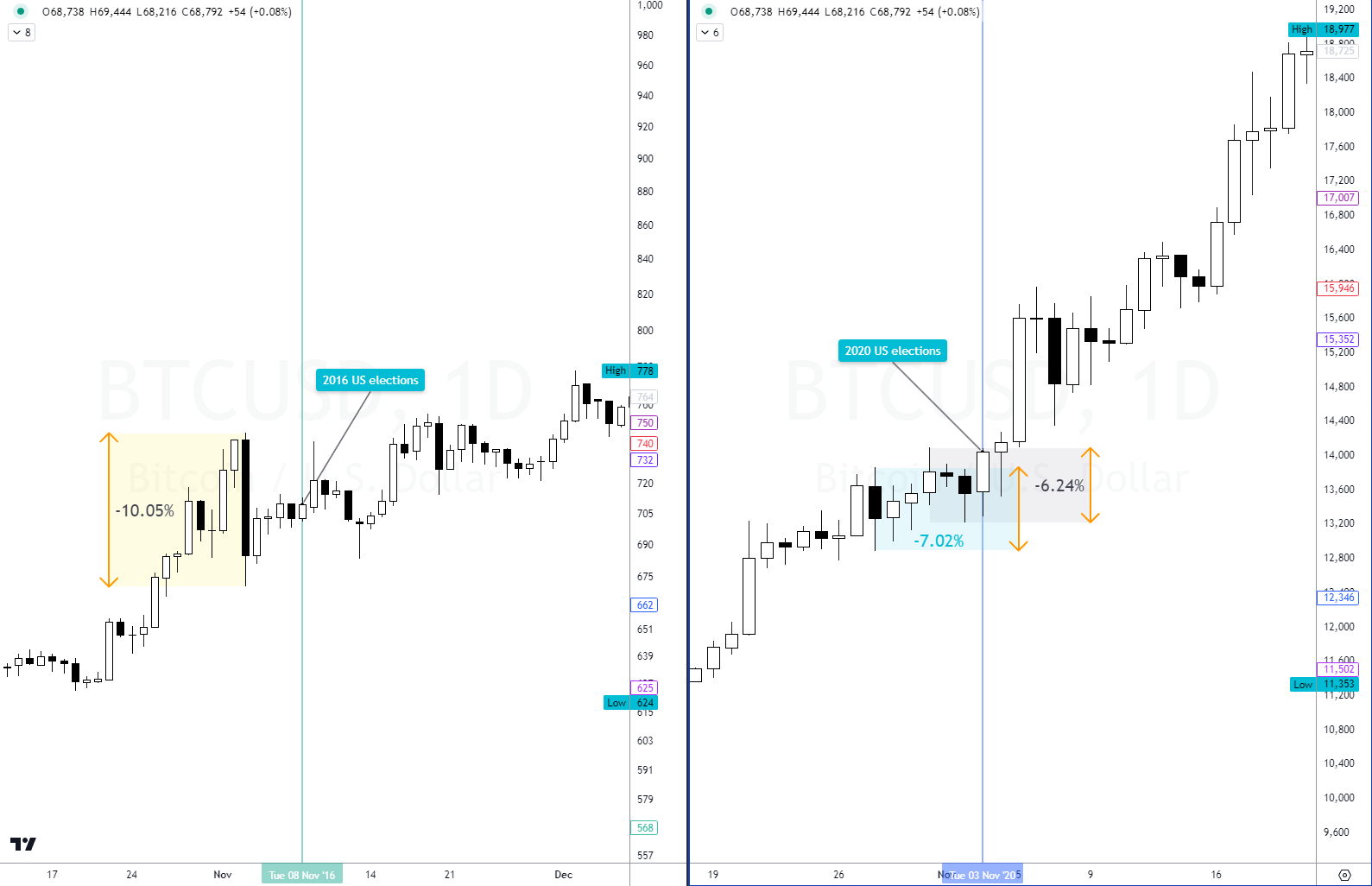

As a side note: Election days typically see heightened risk premiums, with many traders and investors looking to reduce their exposure. bitcoin experienced similar price retracements a few days before the 2016 and 2020 elections, dropping approximately 7% and 10% respectively. Notably, these pre-election lows were never retested after the elections concluded.

Let’s zoom out a bit.

The short-term impact of the US presidential elections on bitcoin’s price appears to be already priced in, suggesting a potential sell-the-news event. I’m not sure if this holds true for Ether, though. It is interesting to see what historical data shows for the post-elections period of bitcoin’s performance (BTC Index). It can help us to understand what might lie ahead:

| Year of elections | 30d performance | 90d performance | 180d performance |

| 2012 | 24.15% | 92.02% | 937.91% |

| 2016 | 9.88% | 49.55% | 135.95% |

| 2020 | 41.75% | 161.89% | 321.88% |

| Average | 25.26% | 101.15% | 465.24% |

The regulatory landscape for bitcoin is improving globally, not just in the US. This trend is expected to continue under the new president, whoever that may be. bitcoin became one of key topics in the US election campaign, which underscores its importance in the political landscape and its role in national interests. I guess bitcoin has indeed come a long way from being ignored and later fiercely opposed as a ‘currency for criminals.’

But, beside bitcoin, there are thousands of other coins and tokens out there that haven’t really profited from positive regulatory development. Yet.

I find this point far more interesting for the post-elections period, potentially providing quality altcoins with strong tailwinds and boosting their adoption. Verticals and sectors like Payments (CFS), zk-Tech, DePIN, SocialFi, DeFi, Abstractions, xVM, and others could experience enormous growth. Currently, many technically sound and battle-tested projects face constraints in reaching their target audience and achieving greater adoption due to regulatory risks, uncertainty, red tape, and selective crackdowns.

US politicians have communicated their ambition for the country to become the world’s leading crypto industry hub, which fuels my optimism for a positive shift in regulatory stance towards quality altcoins. As we know, the crypto industry is much, much more than just bitcoin.

In case of delayed election results (e.g., recounting, contesting, etc.), the short-term volatility period may be prolonged, potentially distorting investors’ long-term perspective. This could drag on into January — the official inauguration is set for January 20th. Reacting to short-term, election-driven market changes might shake out some investors. In other words: if you hold bitcoin and quality altcoins, don’t let occasional price retracements disturb you if your investment horizon is 6-12 months or longer. Similarly, it’s good to keep some capital aside for accumulation opportunities.